Fraud & Forensic Accounting

Fraud is on the rise; trusted employees are stealing thousands of dollars daily from unsuspecting business owners. Are you and your company safe?

Certified Fraud & Forensic Investigations is here to help. Located in Indianapolis, our team of licensed Indiana CPAs and certified private investigators specialize in forensic accounting & use their accounting skills to investigate fraud or embezzlement, and analyze financial information for use in legal proceedings.

At CFFI, we’re certified to reveal the truth about deceptive employees and assisting government agencies in financial investigations. We’re passionate about protecting your company’s earnings, reputation, and peace of mind.

If you want to stop being a victim to financial fraud, or if you want to learn more about how occupational fraud can affect your organization; contact us today at (317) 313-7948.

White-Collar Crime: The Alarming Facts

According to the Association of Certified Fraud Examiners, no business is safe. Its most recent survey, the 2014 Report to the Nations on Occupational Fraud and Abuse, unearthed several disturbing statistics about worldwide white-collar crime:

- The median loss of the organizations surveyed was $145,000, but more than one-fifth of cases involved losses of at least $1 million.

- Losses tend to be much higher when perpetrated by employees with greater authority.

- On average, it takes a company 18 months to realize fraud is taking place.

- Forensic accountants determined that small businesses “…tend to suffet disproportionately large losses due to occupational fraud.” In fact, the study showed that the smallest organizations had the largest median losses.

Speak With a Forensic Accountant Today

Financial Forensics Protect Your Business

While your business is at risk, you certainly aren’t defenseless. Certified Fraud & Forensic Investigations can pair you up with a certified forensic accountant in Indianapolis who can determine whether fraud, waste, or abuse is plaguing your organization. With the accounting and investigations skillset to analyze and interpret your financial statements and records, we will identify who has been stealing, how long it’s been happening, and how much money has been lost. If you decide to prosecute the fraud in your company, your Indianapolis forensic accountant will also assemble and prepare evidence for court or any other legal proceedings as directed by your counsel.

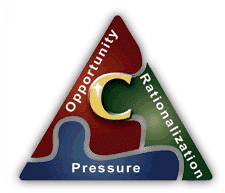

In today’s culture, employees feel pressure to appear successful and support their families and their families’ spending habits, so they rationalize their actions as minor, deserved, or temporary. Unless you take proactive measures to protect your business and its revenues and assets, those employees will seek the opportunity their position affords them for personal financial gain at your expense.

These basic building blocks for fraud were identified decades ago in the “Fraud Triangle,” and still hold true in most fraud cases today. If your business is safe, we want to help you keep it that way. We can evaluate your internal controls to help identify vulnerabilities and make recommendations for additional controls that will eliminate the opportunity for white-collar crime in your workplace. We can also alert you if any suspicious activity arises.

Forensic Accounting

If you think fraud is happening in your company, CFFI can conduct forensic accounting through the following process:

- MEETING with the client to understand the issues, facts, and parties involved

- CONDUCTING a basic investigation to determine the forensic accounting strategy

- COLLECTING the evidence related to the issues at hand, using digital forensics if necessary

- INTERVIEWING the involved parties to gain perspective and gather evidence

- ANALYZING the evidence, to include summarizing transactions, tracing the assets, calculating damages, performing sensitivity analysis, and utilizing computer applications, charts, and graphics

- PREPARING the report to explain the findings in a thorough manner that can be successfully interpreted by non-experts for litigation support

If we do find financial fraud activity, we can figure out who has been stealing, how long it’s been happening, and how much money has been lost. We can even use our own staff of private investigators, who we work with side-by-side, to conduct a background check on the employee in question to supplement the investigation. Not only are we a CPA firm, but we’re also a fully functioning private investigative firm.

CFFI—Going the Extra Mile to Protect You

In a matter as serious as fraud, you need a forensic accounting company in Indianapolis that you can trust. Certified Fraud & Forensic Investigations is a business with integrity that embraces its mission “to utilize our God-given accounting and investigation skills to follow the facts, reveal the truth, and protect the financial interests of the individuals and companies who confide in us.” Our experienced professionals perform our investigations discreetly and confidentially in accordance with all applicable laws and industry standards.

Learn More About Your Options

Additionally, we have a skillset unique to other forensic accounting firms in Indianapolis. Most companies have either CPAs or private investigators, but not both; Certified Fraud & Forensic Investigations is licensed as both a CPA firm and as a private investigations firm. We combine the financial expertise of CPAs with the discreet investigative skills of private investigators to give you the best results in the most professional manner. Our credentials, combined with more than 50 years of private, public, and law enforcement experience, serve to prove that you can trust our professionals to protect your company’s finances.

Statistics indicate that one or more of your trusted employees is compromising the integrity of your business; don’t wait until it’s too late — get Certified Fraud & Forensic Investigations involved today. We would be pleased to discuss our other service offerings in addition to forensic accounting.